What’s Required To Be Financially Independent? The Right Focus!!

I’ve just come back from a family holiday to Melbourne, all refreshed ready to help our clients along with anyone else start their journey to becoming financially free, get on top of their finances and experience more without being worried about money.

Now, that can mean different things to different people. It could be that is to open up more options, the option to cut back your working hours, the option to retire when you want to, to be able to help the kids out, to live a better lifestyle, to have more holidays or just be in a position where you no longer have to worry about money.

Such a great position to be in when you can really control what you do with your time…

Whatever it is, we hope that we can help you start that journey or at least point you in the right direction.

While in Melbourne holidaying with my wife and two young sons we visited the Sports Museum at the MCG.

What a place of inspiration. The many athletes that have achieved so much.

There is so much we can learn from them when it comes to managing our money.

I hope to provide some inspiration to help you begin your journey to financial freedom for your own reasons.

What is it that you want?

Do you want to be wealthy?

Do you want to retire comfortably?

Do you want to manage your money better?

Do you want to be in a position where you don’t worry about money ever again? ie, know you have things sorted.

Whatever it is, the one thing we can learn from successful athletes is they have big audacious goals, whether that is to win gold at the Olympics, win the Australia open or just be the best they can be. They know what they are aiming for.

It’s about knowing what you want to achieve and the reasons you want to achieve it.

Ask yourself the question, what is it that you want from your life and ask why is this important to me?

I think you will find some inspiration in those answers.

What’s required to achieve that goal or aspiration?

Once again, athletes are very methodical when it comes to their training and preparation. They work out what’s required to achieve their goal.

What training must I do?

What skills do I need to master?

What must I know to prepare my body and mind to perform at the top level?

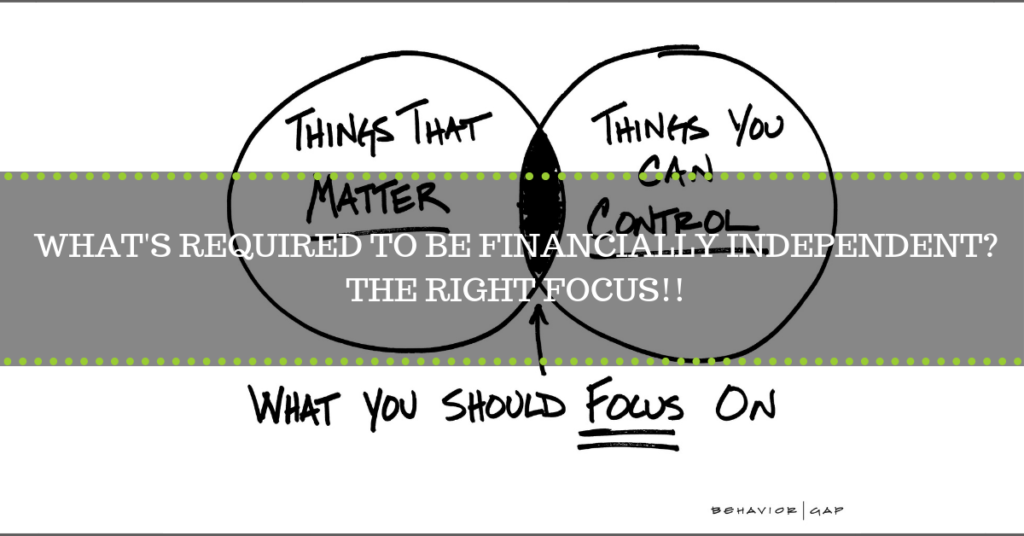

They break it down and focus on the things they control.

They don’t focus on external factors or the end result as in most cases this is our of their control.

They focus on the process.

We are only human, and in this time and particularly this year when things are becoming more volatile, possibly a new government, possible changes to super again and combine that with all the news about the financial services it can play games with our minds and we get to a stage where we are afraid to take action.

You may be thinking this way right now!

The key is to train our mind to ignore these external factors and focus on the basics, the stuff we must do every day knowing at that at some point in time all the hard work will pay off.

No action can be the biggest mistake you can make.

Did you know the biggest regret retirees have is not planning earlier?

Professional athletes know that the first 70% of the achieving the goal is the hardest?

Understanding how to achieve a goal is paramount. All too often people give up part way through because things haven’t gone the way they had expected or it just becomes too hard.

One good example is you start investing, then you experience a loss early on in the investing experience, you then think this is not going work and ultimately pull out of it all and never do it again.

However, understanding the dynamics of how it all works can help you make better-informed decisions.

I’m going to write an article about this in the next couple of months as I think it is one of the misunderstood concepts.

We, as financial professionals and I’ve been doing this for 20 years know that the first 70% of any goal is the hardest to achieve.

The next 30% takes a lot less time and effort due to a very powerful concept called compounding.

If you can block out the noise, albeit hard in a world of 24/7 news and competing views and focus on the factors or actions you can control, the road to financial freedom can be much easier to achieve.

It’s about knowing the rules to the game and knowing how to master those rules to win your game of finance.

Too many people have made it more complicated than it needs to be.

Professionals employ coaches to keep them accountable.

Yes, that’s right.

They know that to achieve their big audacious goals they need experts around them to fast track their results. To prevent them making the mistakes that others have made to fast track their success.

However, the biggest benefit of coaches is to keeping them accountable.

Even athletes can get sidetracked.

I even have a business coach to keep me accountable to my business goals and to keep me on track.

You might be someone that is looking for help but given the publicity about the financial services are shy or just don’t know who to turn to that you can trust.

You also might be someone who has had a bad experience with an adviser previously.

Don’t worry, I’ve seen it all over my 20 years in this industry.

You have every right to be nervous, or even thinking you can’t trust anyone. There have been some downright shonky practices in the financial services industry.

The good news, you just need to find the good eggs and let me tell you there are plenty of them.

I will also be writing a post about picking a financial adviser shortly.

In short, there are two types of advisers, the product floggers and the ones who will take the time to listen to what it is that you want to achieve first and provide appropriate solutions to help you get there.

We are happy to say we are in the business of helping people transition from where they are to where they want to be.

Whether that is to get on top of your money, plan the path to financial freedom, make better informed decisions about your money, build the financial foundations that will make you successful in managing your money right or just helping clients safely transition from a pay cheque to a sustained income in retirement. All done without the complexity.

I am happy to say we don’t sell products, in fact, I have no requirement to use any particular product, we use what’s going to get our clients results. At the end of the day, that’s all that matters, results.

In fact, we don’t even sell to potential clients, it’s generally a natural progression from a conversation, uncovering what they need, determining what’s required to fill the gap and the help they need and if there’s a natural fit we’ll start working together.

It’s as simple as that, and you know what we have many conversions where people may not progress to become a client for a couple of reasons, there may not be a good fit or simply they do not require our help.

But, what they get is a gameplan they can go and implement themselves, no product flogging, we’re in the business of helping clients lead great lives, simplifying their finances and holding them accountable to their goals.

You could say that we are their financial sherpa’s, you determine the goal and we’ll be by your side helping you make the right decisions along the way, protecting you from the financial pornography and helping you to focus on what you can control.

Oh yeah, we do not charge based on a percentage of your money like most planners do. There is an inherent conflict here.

We charge flat fixed fees based on the work and the complexity, therefore, it doesn’t whether you have a lot or just a little.

In fact, we have some clients with very little money we manage, however, we provide the guidance they require to achieve financial success, protect their assets so that they can comfortably experience more in life.

Just a little insight into what we do.

As always you might be a little skeptical, that we are trying to sell our services.

Sure, we’re looking to help more people get on top of their money, achieve more and ultimately lead a better life without the stress of having to worry about money. For that, I make no apologies.

If these posts help you make a positive change, great, it’s served its purpose, however, if you are someone that is considering seeking advice, feel free to pick up the phone and we’ll start with a chat. We promise not to sell you anything.

Here are some recent post’s that you may have missed that might be useful to get you in better shape when it comes to your money:-

The formula to financial freedom, the simple way, CLICK HERE>>

Six Steps to financial freedom, CLICK HERE>>

Smashing your financial goals is never easy, CLICK HERE>>

Managing market falls, CLICK HERE>>

The only metric you should be following, CLICK HERE>>

So, if you’re a professional earning a good income, business owner or someone planning for retirement and are wanting to create your path to financial freedom with more certainty with less stress and anxiety feel free to book in a 15 min Possibilities call here>>> and we can help you work out what that first step is for you.

I’ll be honest here, we won’t do your pushups for you, but if you are motivated for the right reasons we can save you a lot of time and heartache and save you from the mistakes most people make to fast track your way to wealth.

Ps. We don’t sell you anything on this call. We will help you determine what the next step is for you. However, if you are someone who is looking for a get rich scheme, silver bullet or believe you know everything we are not for you. If you are someone who really wants to achieve financial freedom, committed and wants to work collaboratively then we can help.

Hope that’s been useful.

PS. Can you help? We are preparing a new resource to help people 5-10 years out from retirement make better decisions so they can retire in style, live the lifestyle they always dreamt of. Can I ask you complete our survey to help make this resource even more valuable and useful? CLICK HERE to complete>>

Know someone that would gain benefit from the information in this email, feel free to forward on.

Glenn

Make it a great Life!

Challenging the Status Quo!

Glenn Doherty – CFP – Founder & Financial Organiser at Jigsaw Private Wealth

Website: jigsawprivatewealth.com.au

Email: gdoherty@jigsawprivatewealth.com.au

Mob: 0401 253 729