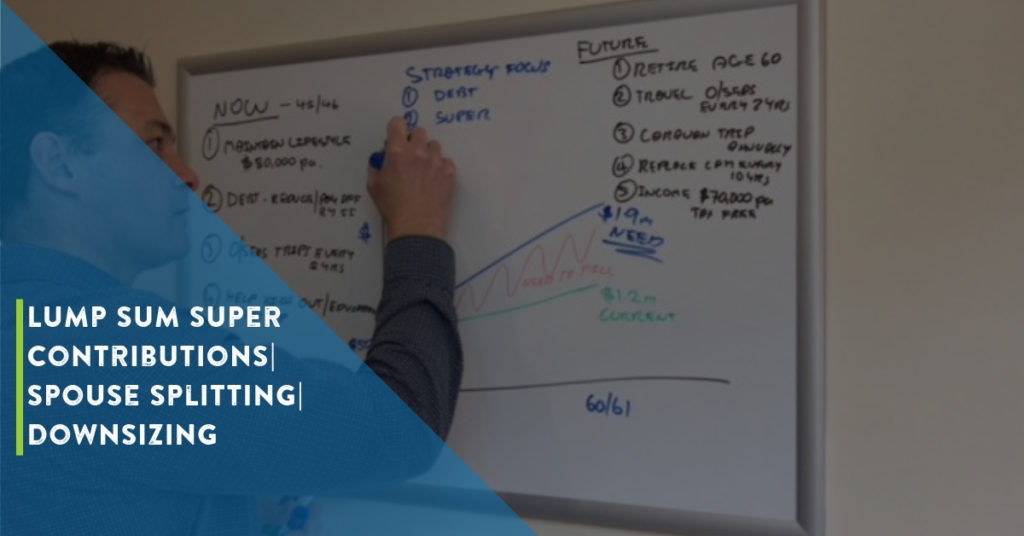

Superannuation Part 3|Lump Sum Contributions|Spouse Splitting|Downsizing provisions

So, here we are.

We’ve gone through the most common tax effective strategies in our previous post. If you did not read it, you can read it here>>

Next, we are going to take you through the new rules relating to lump sum contributions and what you can and can’t do.

Why would you even consider making lump sum contributions?

For most the thought of making big contributions is normally something that is left until closer to retirement. It normally comes in the form of an inheritance, sale of an investment property or excess income where you have already reached the tax-deductible limits.

Those who do make these contributions, it is normally with money they do not require for anything else. They are happy to leave it locked up in super until they retire or able to access it.

If your income tax rate is over 30%, there is a significant benefit in having the funds invested inside super. The tax rate on earnings is 15% and capital gains 10%. So, for most, there is a significant tax saving to be had by placing the funds inside super.

Once you are fully retired and start taking an income from your super the earnings are tax-free and the income you tax is also tax-free.

How much money can I hold in my super fund?

It all depends. The government has recently changed the goal posts.

How much you hold in super is going to depend on how much you have contributed over time and investment performance, so there is no actual limit.

However, there is a limit on how much you can retain in pension phase (that is where you take your income from). That limit is currently $1.6m per person. So a couple could essentially have up to $3.2m between them and not pay any tax on the earnings.

You can retain more than this is super, it just means you will pay tax of 15% on the earnings and 10% capital gains tax. Depending on the tax you pay in your own name you may be better off holding the remainder in super.

What are my limits on making lump sum contributions?

You may make an annual lump sum contribution of $100,000 pa or alternatively, you can make a total contribution of $300,000 over a three year provided you are under age 65.

This is provided your super balance is under $1.4m.

If all your super balances combined are between $1.4m-$1.6m, this amount is reduced.

Balances between $1.4-$1.5m, your maximum lump sum contributions are up to $200,000 over two years while under age 65.

Balances between $1.5-$1.6m, your maximum lump sum contributions are up to $100,000.

I’m approaching my super balance limit but my partner’s super is a lot less, how can I take advantage of that?

What a lot of people don’t realise is there is a strategy that involves transferring contributions made via salary sacrifice or employer contributions. These can be transferred each year to your partner’s super account. This is one way you can maximise your super balances between the two of you.

What this means is that if your partner has a lower super balance and you are starting to approach your limits, this is one way of ensuring you can maximise the limits between the two accounts.

There is planning involved in this one but can provide substantial tax benefits down the track.

Example 1: Using super spouse splitting to take advantage of two $1.6m thresholds

Alan and Belinda are aged 50. Alan’s a medical specialist and Belinda works 4 days a week as a business manager. Due to Alan’s large income, we estimate that if he continues on his current track he will exceed the $1.6m in years to come. Belinda’s, however, is lower due to time off looking after the kids and differences in income levels.

Given Alan is self-employed, he can now only contribute $25,000 and claim a tax deduction for it. He will taxed at 30% given his high income. Each year Alan can transfer this contribution to Belinda’s super ($18,000 after tax). Although this may not seem a lot he will all add up over time and allow them to maximise the $1.6m in each super fund.

Example 2: Using super spouse splitting to pay the mortgage down at age 60.

Joe & Sally, both working, however, there is a difference in age between the two of them. Joe is 48 and Jackie aged 52. They are looking to get as much into super and given that interest rates are low they want to take advantage of the tax benefits available via salary sacrifice. They are looking at taking advantage of a transition to retirement pension when Jackie is aged 60 to assist in paying down their mortgage prior to retirement.

At the start of the financial Joe transfers all the employer and salary sacrifice that has been made to his super less tax to Jackie’s super.

By applying this strategy they generate an immediate their on their money of over 30% and are able to build up Jackie’s super fund significantly to allow them to draw a larger tax free pension to help pay the mortgage down prior to retirement.

Downsizing super provision

If you are considering downsizing your home post 65 any excess after purchasing another home you are able to contribute to super up to certain limits.

You can contribute up to $300,000 each into super as part of a sale of your main residence.

What you need to know?

There is no work test rule.

You must have owned the home for 10 years prior and it must be your main residence.

You can contribute up to $300,000 each into super.

This is on top of any other contributions you are making to super.

If you have exceeded the $1.6m pension cap, you can still contribute this to super but it will be allocated to an accumulation account.

Must contribute the funds within 90 days of receiving the funds.

You must submit a downsizing contribution form.

As you can see there are many ways you can contribute to super. It’s imperative that you have some sort of plan on how and when you are going to make contributions to your super. It may mean you start planning many, many years out from retirement.

If you haven’t already downloaded our Start Right Guide to Designed Retirement Lifestyles Guide you can download it by clicking here>>

If you have any questions relating to the above feel free to email me at gdoherty@jigsawprivatewealth.com.au

NEXT STEPS:-

Feel like your confused about how to take control of your money, where to start and how to make it work harder for you? Book a 15 min Fast Track call here>>

I have 4 spots left this month…

We’ll get on the phone for a quick chat and:-

- Have a quick look at the issues you are facing or wanting to address and perhaps a couple you don’t know about.

- Help you diagnose what might be getting in the way.

- Give you clarity about the main actions you should be taking now to get you ahead quicker.

Make it a great Life!

Challenging the Status Quo!

Glenn Doherty – CFP – Founder & Financial Organiser at Jigsaw Private Wealth

Website: jigsawprivatewealth.com.au

Email: gdoherty@jigsawprivatewealth.com.au

Mob: 0401 253 729