Retirement planning lessons from the Navy Seals and SAS

The unpredictable events of 2020 has taught us some deep lessons. That no matter what the world throws at you, you must be agile in your planning.

We only have to look as far as the Navy Seals and the SAS. Learn from how they prepare for stressful and highly volatile situations. How they manage these situations and achieve successful outcomes. And apply them to your retirement planning so you too can be confident and successful.

Retirement planning lessons you can take from the Navy Seals and the SAS:

#1 There is no perfect plan. Except for the planning room.

Yes, we would all like a perfect plan. It would make life so much simpler. However, there are many events ahead of you which are unknown at this point in time.

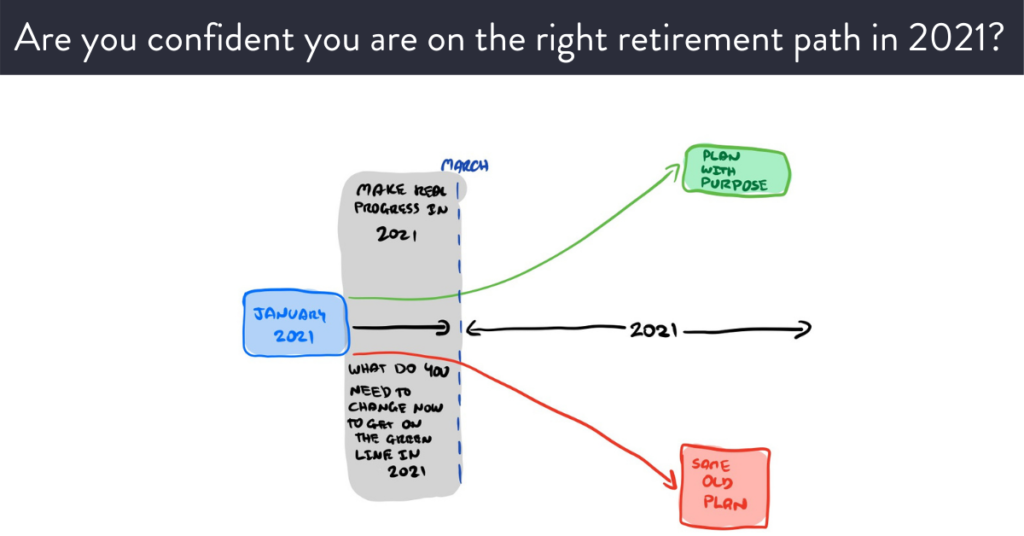

Planning for retirement is all about narrowing in on the next potential outcome. Taking small steps towards your future is key. But be flexible.

Value is in the ongoing planning process.

#2 Respond to a situation, do not react.

Reacting is cashing in your investment portfolio when the market crashes. Emotion driven.

Responding is assessing the situation. Assessing all your options and possible outcomes. Once you have done this, you can take the necessary action. More often than not this will save you time and money in the long term.

#3 Keep it simple.

Unfortunately the financial services industry is guilty overcomplicating it. A product and solution for every problem and catering for every need. Many overcomplicate it.

Keeping it simple requires skill and discipline while blocking out the noise.

#4 You can only control or have impact on things within the wingspan of your arms.

Many stress about things that are out of their control. Think market movements, political decisions, job losses, inflation and investment returns to name a few.

But there are many things inside your wingspan. How much you save. How you invest your money. Whether you stay invested or not.

Think simple controllable steps which will compound over time.

#5 Long-term goals are achieved through countless small steps and victories – celebrate them.

The road to an abundant lifestyle is a long journey, even more with people living well into their 90’s.

When you achieve a short term goal, think buying a new car, taking your dream holiday or retiring – take a victory lap.

Life is too short to not celebrate the little victories on your long journey.

It’s important to understand what your future journey could look like. For instance leading into retirement and through your early years of retirement. There’s a distinct change in thinking required to navigate this important and stressful transition.

Video| A paradigm Shift to Confidently Navigate Retirement (approx 11 mins)

We walk you through this change in thinking from your working years to your retirement years. A paradigm shift to confidently navigate your retirement.

Click here to watch the video.

Ready to find out what you need to do to stay on track and live an abundant lifestyle with confidence in retirement. I’d be delighted to have a chat.

Glenn Doherty – CFP – Money Mentor | Taking the stress out of planning your self-funded retirement | Founder of Jigsaw Private Wealth