Have You Got The Balance Right?

Have You Got The Balance Right?

Do you remember the good old see-saw?

You don’t hear of them much anymore, in fact, I don’t know the last time I saw one in a playground!

I used to love them as a kid, up and down, up and down. I was the type of kid, yes the naughty one, who at the bottom would jump off only to watch the kid on the other end tumble back to the ground with a great big thud as the balance of the see-saw changed.

Sure, I had my fair share of falling back to the ground as people jumped off the other side. It was never a great feeling.

The premise was to keep the balance on both sides of the seesaw so you could enjoy the even up down.

But Glenn, what does this have to with investment portfolio’s you might say?

It’s about finding the right investment balance on a regular basis so you don’t come back crashing to earth. So you don’t experience the pain of uneven risks in your investment portfolio, particularly in retirement.

Just like the person jumping off the seesaw at the bottom. There is uneven weight distribution, and usually, there is some pain or discomfort involved.

In our last post, we discussed the importance of balancing out the risk you take in comparison to the life you want to live. Call it the minimum amount of dosage of risk to get the job done, not the maximum amount of risk. If you missed it you can catch up by clicking here>>

What is rebalancing?

In our previous post, “Investment Portfolio Safety Drill – Part 1”, we discussed how to assess the amount of risk you need to take and what different types of risk levels looked like.

On often overlooked part of retirement planning is rebalancing your investment portfolio. It’s safe to say that it could make or break your retirement if you do not manage it on a regular basis.

Here’s a great chart from Vanguard Investments showing the impact of rebalancing and not rebalancing:

Let’s look at an example. Let’s say in 2016 you set your portfolio up with an allocation of 60% shares and property (growth investments) & 40% cash and bonds (conservative investments).

The investment markets have been pretty good since 2016, right?

It’s likely the growth part of your portfolio has done well while you’re more conservative side has been ho-hum.

If you did nothing, your portfolio allocation might look something like this:-

80% growth/20% conservative

Your risk level has completely changed. See our previous post and review the chart to see the increase in risk here>>

Rebalancing would mean selling some of your growth investments and buying more of your conservative investments.

Confirmation Bias!

But, hey Glenn why would I want to sell investments that have been doing really well for me and buy the investments that have performed poorly you might ask?

Shouldn’t I just be buying more of the ones that have been doing well?

It seems against everything we believe in, right?

So, it’s normal to just let things go when they are doing well.

We’re only human after all.

We’ll look for every reason, every bit of information that supports our thinking. You are going to seek out all the information that supports you’re thinking about retaining those investments rather than rebalance and do the complete opposite of what you should do.

It’s called confirmation bias and we all do it, me included.

Let’s look at the depths of the Global Financial Crisis for example. At the bottom, undertaking a rebalancing exercise in your investment portfolio was a scary experience.

Let’s think about it for a minute.

You’re being asked to sell your most conservative investments only to buy growth investments that have suffered a 50% drop.

How scary is that? Why wouldn’t I just buy more of my conservative investments?

If we take the emotion out of our decision-making process which is extremely difficult, and just follow a well thought out process everything will work out.

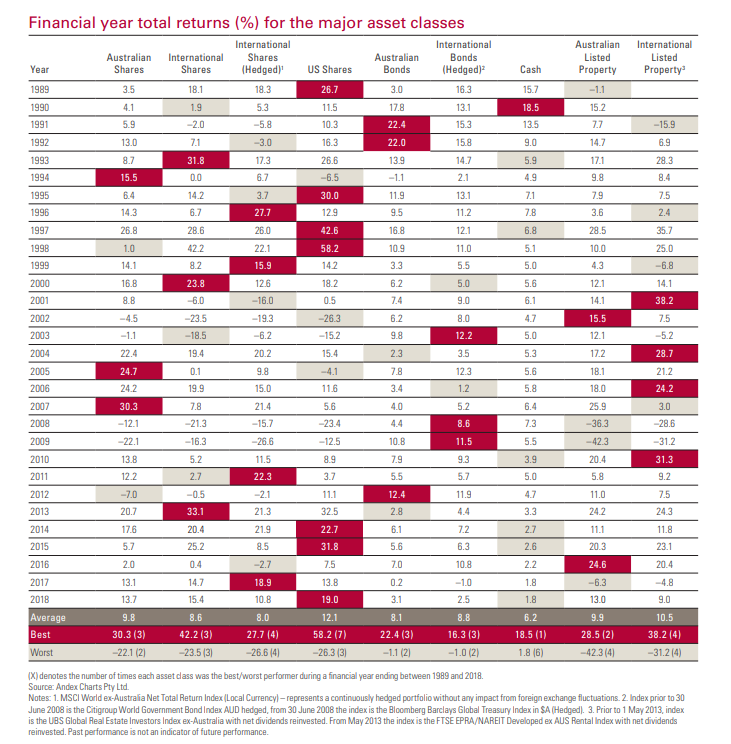

You see, all investments have their time in the sun, one year it will be Australian shares that perform the best, the next International and then Property. They all move in cycles.

Just take a look at this chart from Vanguard Investments:

If it’s against everything we believe in, why should I rebalance?

As we do for all our clients, we assess the level of risk they need to take to get the job done, so they can ROCK RETIREMENT!

We implement a disciplined investment strategy that takes out all the emotional decision making that gets in the way of success.

You have your comfort level set, the amount of downside you are willing to take.

As we presented in the example above, the amount of risk in the investment portfolio has increased significantly.

As always, no one knows what investment markets are going to do, not even the experts!

Rebalancing is a critical step in safeguarding your investments pre-retirement and in retirement.

So, when should I rebalance?

There is no hard and fast rule with how often you should rebalance.

However, if you are working with a good adviser, they will assist you in making the right decision based on your unique circumstances.

Ideally, undertaking this exercise once a year would be sufficient. There is no real evidence to suggest that doing it any more regularly adds any more value.

In some instances, it’s ok to let investment portfolio allocations run a little. That is you allow a range that you are comfortable with prior to rebalancing. You might allow, say 5-10% over the level of risk you are comfortable with prior to rebalancing.

There are also other issues to take into account, such as timing for capital gains which may impact your decision to rebalance. However, tax should not be the driving factor in holding off a rebalance.

With our clients, we generally allow a range somewhere between 5-10% prior to rebalancing. Given we know our clients very well, we know the ones that are happy with a little more risk and the ones who could not cope with increased risk levels.

It’s important to know what you are comfortable with tied to the life you are trying to live and follow a well thought out process.

Problems start arising when you deviate from the process or plan.

The key to any successful retirement is to have a well thought out plan, both leading up to retirement and while living your life in retirement.

Practical Planning:-

- Locate a copy of your investment portfolio with the different investment allocations on them.

- Compare it to the comfort level you have.

- Make the necessary changes to bring your asset allocation back into line.

Hope that’s been useful:-

Now, go ROCK RETIREMENT…

Have You Booked Your ROCK RETIREMENT CALL?

Struggling to work out where to start or whether you are on TRACK to Live your DREAM Retirement?

Book your Rock Retirement Call now!

What will you achieve on this call?

We won’t be selling you anything, there won’t be time for this. Given the investment of time in these calls we’ve had to limit them, so if you find all the times are taken, you’ll have to wait until next month.

You’ll achieve 3 things from your call:

#1 We’ll help you define the lifestyle you are working towards, even if it’s only a guestimate, it’s something you can start working on. We’ll help you define the cost of it.

#2 You’ll receive a short report, detailing all the important that will put you in a position where you have more control over the direction you’re heading in.

Your short report will contain:-

- A detailed listing of your dream retirement lifestyle

- You’ll know what your Dream retirement will cost

- You’ll have the information to know whether you are on track to have enough

- We’ll provide some options you can consider to improve on your current position

#3 Two Bonuses

- Because we know life is busy, we want to make sure you get practical information you can use. Firstly we’ll give you access to our interactive risk profile tool. It’s something new we have introduced for clients. Rather than answer questions that most use in the industry, this interactive tool is backed by science. You are given six scenarios and you choose the level of upside and downside you are willing to accept. What you get is an answer to the real risk you are comfortable taking with your investments. Never be in doubt.

- Want to know you are going to have enough. We’ll also stress test your retirement plan for you. We’ll run it against different market cycles. You’ll know how you’ll fare against a base case scenario, pessimistic and optimistic scenario’s. You’ll have the information to make an informed decision about the amount of risk you need to take to get the job done.

You’ll have 80% of the information to better your retirement plan and make the most of the only life you have.

CLICK HERE to book now>> These calls are limited.

Know someone that would gain benefit from the information, feel free to forward on.

Glenn

Make it a great Life!

Challenging the Status Quo!

Glenn Doherty – CFP – Founder & Financial Organiser at Jigsaw Private Wealth

Website: jigsawprivatewealth.com.au

Email: gdoherty@jigsawprivatewealth.com.au

Mob: 0401 253 729