BLOG

The idea of retirement has changed; we need to look at things differently. Figuring out how much you need, your “ENOUGH” number, is simply mechanical, and software can do that. We all know retirement is a big deal. It’s something that needs to be planned for. It’s a time we all look forward too. A…

Read MoreHow much is ENOUGH? The number one question you should be asking prior to doing anything with your super. This number will dictate how much you need to contribute to super. How you invest your money and the level of risk you need to accept. Many have no idea what they will need to fund…

Read MoreMany struggle with what super strategies they should be using. Let alone knowing what’s available to build their nest egg. Others worry about the performance of their super fund. Let me be clear! Don’t confuse investing with your super tax structure. They should be treated separately on their own merits. If you’re anywhere up to…

Read MoreMany of us are living longer than we ever expected. We need our retirement nest egg to last longer. This is why understanding your super is an important part of the retirement planning process. You need to be making contributions to your super fund. With so many different types available it can be overwhelming trying…

Read MoreEverybody wants to retire comfortably, but few people know how to get there. One of the most important assets you can accumulate for your retirement is superannuation. But what are the ins and outs? What does it do? How does it work? In this blog post we’ll answer these questions and more! What is superannuation?…

Read MoreWith a buffet of investments available, how do you choose which ones to invest in? Do you go for the healthy low risk options? Or take a risk and go for the sugary options. The ones which will give you a high and come crashing down as the high wears off. When thinking about the…

Read MoreA critical cog in your retirement plan is getting your investment strategy right. After you’ve determined what you want to achieve in retirement. Know how you are going to fill your 168 hours in a week, so you don’t get bored. Worked out how much your retirement is going to cost. Understand how you are…

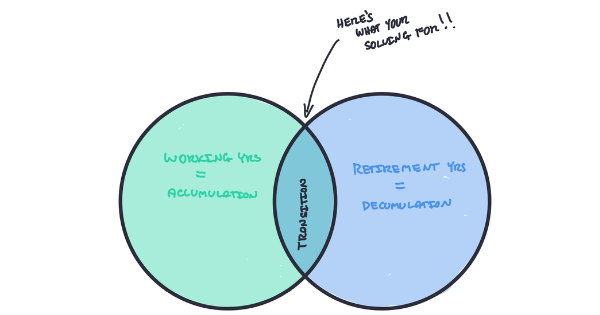

Read MoreYou spend your whole working life accumulating assets with the ultimate goal of reaching the summit (retirement and living a fulfilling life). Focused on achieving the best return you can along the way. After all, you can take on a reasonable amount of risk knowing you have your employment income to fall back on. Besides,…

Read MoreWhat’s the advice to soccer stars who earns millions in a week? European soccer stars earning thousands a day stick to cash… Recently I ventured out for a casual dinner with a couple of industry colleagues. In the middle of my meal. The conversation turned to misguided conversations financial advisers are having with their clients.…

Read MoreTime and time again we hear comments like: My fund averaged XYZ this year. My fund is the best returning fund. This fund generated XYZ over the last 3 years, why didn’t mine do that well? But is this an accurate assessment? Is it a true reflection of the return/real $$$ you’ve received? Can you…

Read More